The Astria Bridging Protocol

Elizabeth Binks

Feb 26, 2025

Originally posted on HackMD.

Astria has developed a native bridging protocol for rollups built on the Astria sequencing layer to transfer funds to and from the Astria sequencing layer and between rollups built on top of it. Rollups can opt-in to using this protocol by enshrining it into their consensus.

To enshrine the protocol as part of a rollups consensus, and therefore implement deposits of tokens from the Astria sequencer, all the rollup has to do is create a sequencer bridge account and assign a specific sequencer address as the bridge operator. Incoming transfers to this bridge account are locked in the sequencer and minted on the rollup. This is similar to how existing L1-to-rollup bridges work, where some lock event happening on the L1 results in a deposit transaction being derived automatically on the rollup. Note that since deposits are a lock-mint, withdrawals are a burn-unlock.

Withdrawals from a rollup back to the sequencing layer happen in two steps: (1) tokens are burned on the rollup and (2) the corresponding tokens are unlocked on the sequencing layer to the destination address. The rollup-side tokens serve as a receipt for assets locked on the sequencing layer, and burning them absolves their holder of the receipt to the unlocked tokens. Bridge operators are trusted to settle withdrawals on the sequencing layer, and the protocol is currently secured by a threshold signing protocol between operators. Future upgrades to the sequencing layer will provide trust minimized guarantees using validity proofs.

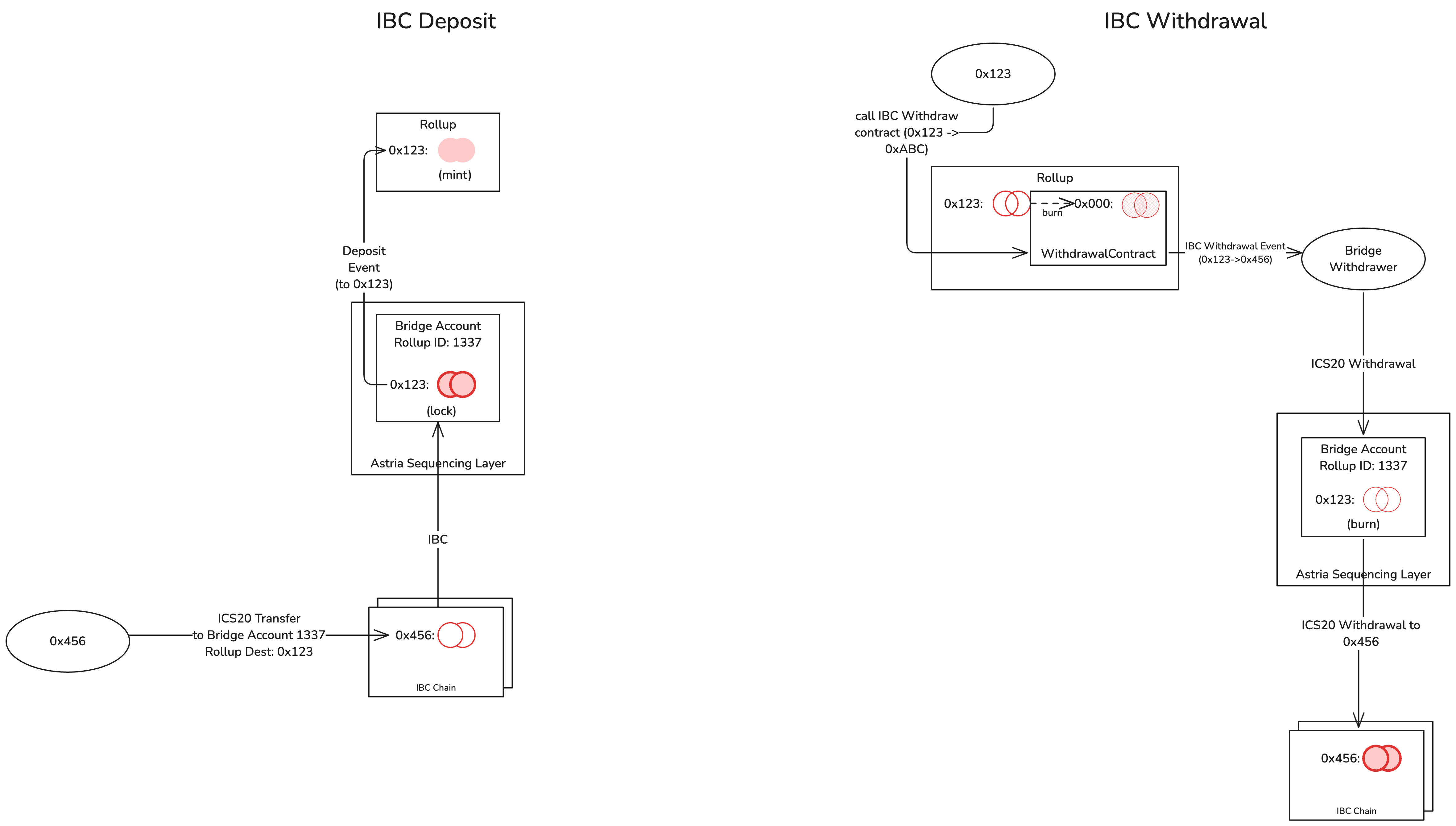

Since assets can be bridged to the Astria sequencing layer via IBC, the rollup bridge enables one-click deposits from and withdrawals to other chains that use IBC. IBC and the Astria bridging protocol are two distinct mechanisms that can be composed on the Astria sequencing layer. IBC handles transfers between the sequencing layer and external Cosmos-based chains, while the Astria bridging protocol handles transfers between the sequencing layer and its rollups. Because they’re composable, an incoming IBC (ICS20) transfer can be combined with a rollup deposit in a single transaction, and similarly, a rollup withdrawal can be combined with an outgoing ICS20 transfer. This allows any Astria rollups to access any IBC asset.

Flame, the home of Celestia native DeFi, leverages this to provide users with one-click bridging of TIA from Celestia to Flame, where TIA is used for gas.

Depositing from the Astria Sequencing Layer into a Rollup

At a high level, the sequencer-to-rollup protocol works as follows:

A bridge account is initialized on the sequencing layer with an associated rollup ID, from which the rollup reads its block data.

The rollup enshrines the bridge account into its consensus, designating transfers into the bridge account on the sequencing layer as

Deposits of a specific asset, deriving the corresponding mint for the synthetic token on the rollup.Users then send transfers to the sequencer bridge account, which result in

Depositevents being included as part of the rollup's block data.When the rollup sees a

Deposit, it mints the corresponding tokens to the user's account.

Withdrawing from a Rollup to the Astria Sequencing Layer

The rollup-to-sequencer protocol works as follows:

The bridge account has an associated withdrawal key, which may be secured by a threshold signing scheme. Operators sign transactions which unlock funds out of the bridge account to other accounts on the sequencing layer.

There is a withdrawal contract deployed on the rollup. Users can burn their rollup assets via this contract, which emits

Withdrawalevents to unlock the corresponding funds on the sequencing layer.The bridge withdrawer operators watch for

Withdrawalevents on the rollup. For each event, a corresponding BridgeUnlock action is created, signed from the bridge account, and submitted to the sequencing layer for settlement.

IBC Bridging

Deposits and withdrawals through the Astria Bridging Protocol can be seamlessly composed with ICS20 transfers, allowing for interoperability between rollups and IBC-enabled chains. An ICS20 transfer into the sequencing layer can use a bridge account as its destination, using the memo to specify the rollup account destination for the deposit event. Similarly, rollup users can use the IBC withdrawal contract to emit a withdrawal event that specifies an IBC-compatible destination, with the associated metadata. In both cases, the sequencing layer composes the IBC call with the native rollup bridge logic to provide rollup users with a one-click bridging experience regardless of their source or destination chains.

Flame Bridging

Flame, the home for Celestia native DeFi, has the Astria Bridging Protocol enshrined in its consensus. This means that Flame gets out-of-the-box bridging functionality, enabling seamless asset transfers:

Depositing from the Astria sequencing layer to Flame: Assets are locked on the sequencer and minted on Flame.

Withdrawing from Flame to the Astria sequencing layer: Assets are burned on Flame and unlocked on the sequencer.

Between rollups built on Astria: Flame can seamlessly transfer liquidity between other Astria rollups that use the same bridging protocol.

Across IBC-enabled chains: Because Astria natively supports IBC, Flame automatically inherits the ability to send and receive assets from any IBC-connected chain.

Astria’s IBC integration allows Flame to use existing ICS20 assets such as TIA from Celestia (used for gas), USDC from Noble, and all existing TIA LSTs: dTIA from Neutron, milkTIA from Osmosis, and stTIA from Stride. All of these assets are supported with a one-click bridging experience for both deposits from the origin chain to Flame and withdrawals from Flame back to asset’s origin chain.

References

https://github.com/astriaorg/astria/blob/main/specs/bridge.md

Thanks to Itamar Reif for the diagrams and comments, as well as Josh Bowen, Eshita Nandini and Dino De La O for the suggestions.